Everything you need to know about Stamp Duty

When you’re buying a property, Stamp Duty can be a significant expense that you need to consider. So, read on to find out when the tax is paid and how to calculate a potential bill.

According to data published in IFA Magazine in June 2025, the government collected £14.1 billion in Stamp Duty in the 12 months to the end of May 2025. The figure is a 20% increase when compared to the same period a year earlier.

With the threshold for paying Stamp Duty halving on 1 April 2025, very few properties will be exempt from the tax, so the amount could increase even further in the coming year.

Please note, Stamp Duty is paid in England and Northern Ireland. There are similar taxes in Scotland and Wales, known as “Land and Buildings Transaction Tax” and “Land Transaction Tax” respectively, which have different thresholds, rates, and reliefs.

Stamp Duty is paid when you purchase a property or land

Stamp Duty is a type of tax you may pay when purchasing a property or land in England and Northern Ireland if it’s worth more than £125,000.

The rate of tax you pay will depend on which band the portion of the property’s value falls into. So, you could pay Stamp Duty at several different rates.

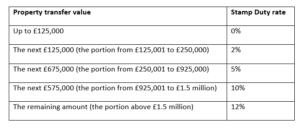

In 2025/26, the Stamp Duty rates are:

For example, if you’re buying a £600,000 property that will be your main home, and you don’t qualify for any reliefs, your Stamp Duty bill would be £20,000. This would be made up of:

- No tax is due on the first £125,000

- A tax rate of 2% is applied to the portion between £125,001 and £250,000, resulting in £2,500 being due in Stamp Duty

- A tax rate of 5% is applied to the portion from £250,001 to £600,000, resulting in £17,500 being due in Stamp Duty.

The government’s Stamp Duty Land Tax calculator could help you calculate your expected bill.

First-time buyers benefit from a relief

If you’re a first-time buyer, you may be eligible for tax relief.

You won’t need to pay Stamp Duty on property purchases of less than £300,000. For properties costing up to £500,000, you will pay no Stamp Duty on the first £300,000 and benefit from a lower Stamp Duty rate of 5% for the remaining amount.

However, if the property you’re buying is worth over £500,000, you won’t benefit from first-time buyers’ relief and will pay Stamp Duty at the usual rate.

You are considered a first-time buyer if you’re purchasing your only or main residence and have never owned a freehold or have taken a leasehold interest in a residential property. This includes properties abroad and those you may have inherited.

There is a 5% Stamp Duty surcharge on second properties

If the property you’re buying won’t be your main home and it’s worth more than £40,000, you’ll usually need to pay Stamp Duty at a rate that is 5% higher than the standard rates.

This applies to most second properties, such as a buy-to-let investment or holiday home. So, it’s important to include this in your calculations when weighing up if a property is right for you.

Stamp Duty must be paid within 14 days of completion

Even if you don’t need to pay Stamp Duty, you still need to submit a Stamp Duty return. Usually, your solicitor will do this on your behalf, although you can do it yourself if you prefer.

The return must be submitted and Stamp Duty paid within 14 days of completing the sale of the property; otherwise you may face a penalty.

Contact us to talk about your mortgage needs

If you’re buying property using a mortgage, we could help you find the right lender for you. Please get in touch to talk about your needs and how we could offer support that might save you money.

Please note:

This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Newsletter

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

Word on the street

Thankyou Navigate for helping me buy my first home! Especially to Lewis and Chris- no question ever felt silly and always prompt with replies! Reliable, transparent and easy to deal with - highly recommend! Also thankyou for my surprise moving in hamper! - Nov 2022

A client since 2022

Very experienced and helpful advisors within Navigate. I'd highly recommend to anyone seeking mortgage advice and assistance. - June 2023

A client since 2023

Navigate took the stress out of moving, the team couldn’t have been more supportive. Great service and very easy to work with - the personal touches were a lovely cherry on top. Thank you Navigate! - July 2023

A client since 2023

We will most definitely be referring all of our friends and family to Navigate. We could not have asked for a better service throughout. - Jan 2023

A client since 2023

I cannot recommend Paul and his team more highly. Exceptionally professional and friendly service. Kept us up to date at every stage and explored every avenue to make it work. Quite brilliant. - Feb 2023

A client since 2023

Used Navigate as a first time buyer and couldn't be more happy with how they handled it. The WhatsApp chats and zoom calls are really good to cover every aspect of the purchase and so easy to contact a member of the team. - Nov 2022

A client since 2022

Would highly recommend Paul & team at Navigate Mortgages. A pleasure to deal with. Guided us through the application process and advised us at appropriately at each stage. Would definitely use again - a professional operation. - May 2023

A client since 2023

Having worked in the financial sector for over 20 years I really can't recommend these guys enough. Paul and his team were professionally efficient, being there every step of the way. - March 2022

A client since 2022

Paul, Chris and team were very professional in helping me get my first mortgage. The process was very smooth and they were always available to quickly respond to my questions along the way. Thanks so much. - July 2023

A client since 2023

Posted onTrustindex verifies that the original source of the review is Google. They have all the insider knowledge to ensure me find the perfect mortgage and go through the process as smoothly as possible. This is my first time buying a house, I am so glad with Navigate guide me through this journey. Thank you Navigate.Posted onTrustindex verifies that the original source of the review is Google. A massive thanks to Paul and Rachael and the team at Navigate. Today we move into our dream home...Posted onTrustindex verifies that the original source of the review is Google. After great difficulty trying to obtain a reasonable mortgage for our new house; I was put onto Paul at navigate who was highly recommended. From the get go Paul was friendly, professional and provided in-depth information with plenty of options. As well as finding the best deal Paul was only a phone call away; arranging numerous consultations and responded promptly to calls and messages with any queries or information needed. Even after having to apply for multiple mortgages due to property changes etc the service was consistent and to the highest standard! Thank you so much to Paul and the team! Highly recommended!Posted onTrustindex verifies that the original source of the review is Google. I have had a great experience with Navigate Mortgages specifically Chris Shannon who I dealt with more on a one to one basis. It was fantastic to have someone there to bounce any questions off and make the journey of buying a house as stress free as possible if that is so. I can’t thank Navigate enough and especially Chris, I’d highly recommend to any first time buyers or others to get in touch if thinking of purchasing a property 10/10!Posted onTrustindex verifies that the original source of the review is Google. From start to finish Paul and all at Navigate couldn’t do enough for us.. They made us feel so at ease and the whole process was so smooth from start to finish. Always just a quick message away if we had any queries or questions. Prompt, efficient and professional from start to finish.. We are now a week in to our new home and we have Navigate to thank for helping our families dream become a reality.. We couldn’t recommend you enough!! Thank you so much for everything!!Posted onTrustindex verifies that the original source of the review is Google. Paul and his team were amazing from start to finish. This has been my fourth property I've bought and with this purchase I found myself having to organise little to nothing. They took all the stresses of buying a home away. Thought the use of a WhatsApp group is a great idea and kept me up to date with everything going on. Thanks again guysPosted onTrustindex verifies that the original source of the review is Google. We used navigate mortgage when buying our first house and I honestly couldn't recommend them enough. Paul and his team were so attentive to every step in the process and worked to a high professional standard. They made this whole process so much easier and will definitely be recommending them to friends and family.Posted onTrustindex verifies that the original source of the review is Google. for anybody looking for or buying a new home, look no further than Navigate Mortgages. I cannot recommend Paul and the whole team that work here enough! Myself and my partner first put money down on a new build home 3 years ago and due to site developer negligence, we have only just moved in. It was a lengthy and difficult process throughout, but nevertheless, Paul and the team at Navitage were there for us not only on professional side of things, but also to provide us with comforting words and reassurment on what has been a very testing time in our lives waiting to finally be able to move in. Be it through having to apply twice for a mortgage of us due to continuous delays on our first one ending with it being cancelled, to one of the team members (mainly Paul for myself) acting as an agony aunt of such as we faced continous bad news from both the estate agents and the builders/site developers. We owe a lot to Navigate, they went above and completly beyond what was expected of them, and we can say for sure that any other choice of company would not have handled our particular case as well as Navigate have. A massive thank you to the entire team over there, we couldnt of got here without you!Posted onTrustindex verifies that the original source of the review is Google. Chris was extremely efficient and helpful throughout the home buying process. He was always available to answer questions even if it was during the weekend. Chris made our experience completely stress free, always explained the best products on the market and provided us with an abundance of helpful information. Would highly recommend Navigate mortgages to anyone looking to buy a new house.Posted onTrustindex verifies that the original source of the review is Google. Absolutely fantastic. Not just the service Paul and team offer during the search for the right mortgage, but also, and very surprisingly, the post-service they offer. Seriously super-recommendable.

Let’s chat

Get in touch with our team today for award-winning mortgage advice you can trust.